CRIF in Mexico & Worldwide

CRIF offers banks, financial institutions, utility companies and businesses qualified support in every phase of the customer relationship.

CRIF makes its knowledge and information assets available to consumers through services which are specially designed to help them take decisions calmly and with knowledge of the credit and property markets.

CRIF is committed to digital financial inclusion. We work responsibly to offer innovative solutions to support our customers to enhance access to credit in compliance, granting a digital access and use of financial services by excluded and underserved people.

CRIF is the leading provider in continental Europe of banking credit information, one of the key players worldwide providing integrated services and solutions for business & commercial information and credit & marketing management, and is included in the prestigious FinTech 100, a ranking of the leading global technology solution providers to the financial services industry.

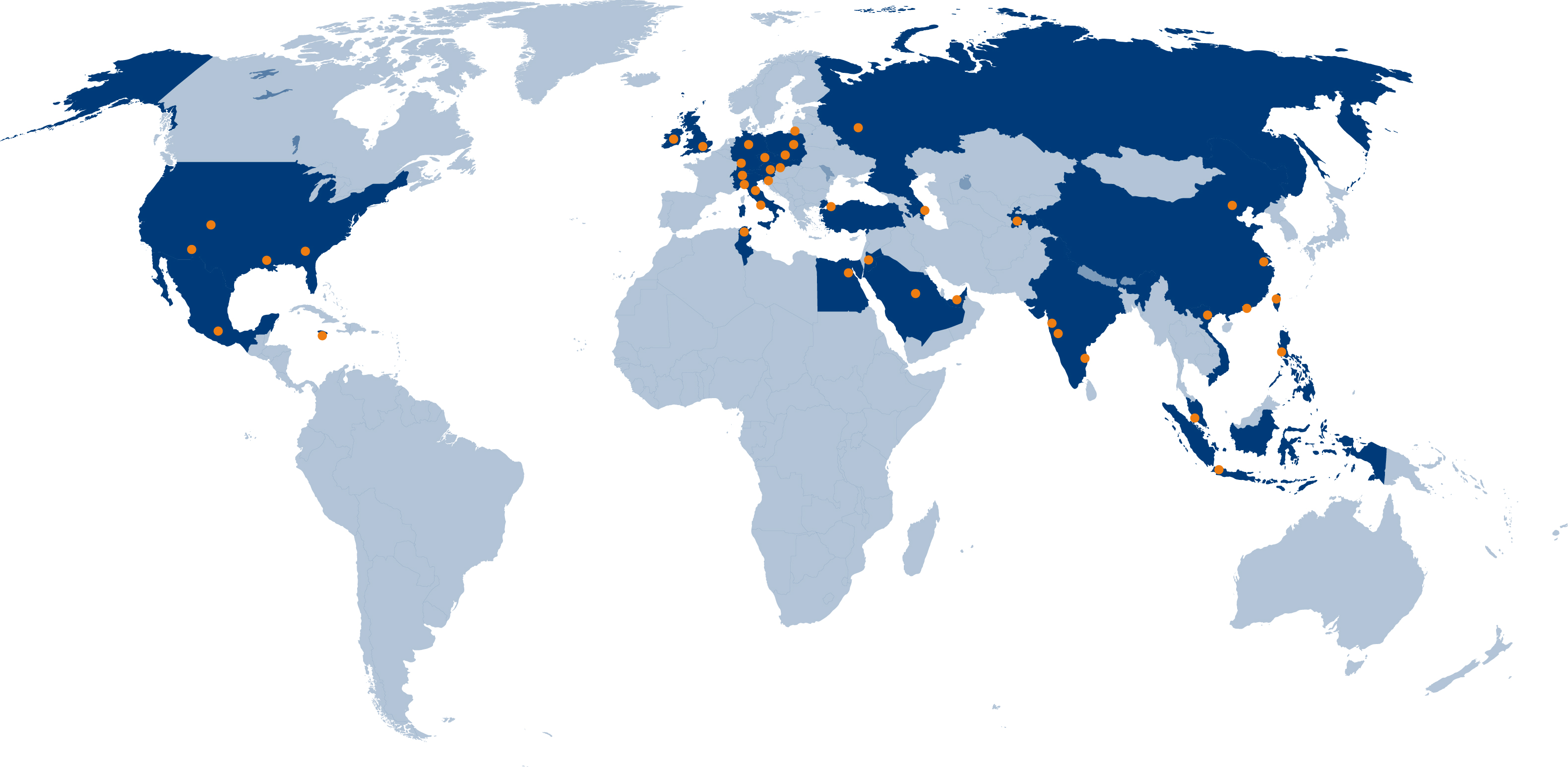

More than 10,500 banks and financial institutions, 600 insurance companies, 82,000 business clients and 1,000,000 consumers use CRIF services in 50 countries on a daily basis.

CRIF at a glance:

40+ COUNTRY BASED OPERATIONS

80+ SUBSIDIARY COMPANIES

4 CONTINENTS

29 COUNTRIES WITH CREDIT REPORTING SYSTEM PROJECTS

500+ SOFTWARE INSTALLATIONS

6,600+ PROFESSIONALS AT YOUR SERVICE

CRIF worldwide presence

ARGENTINA

- Buenos Aires

AUSTRIA

- Vienna

BAHAMAS

- Nassau

CHINA

- Beijing

- Hong Kong

- Shanghai

- Shenzhen

CZECH REPUBLIC

- Prague

EGYPT

- Cairo

GERMANY

- Amburgo

- Karlsruhe

JAMAICA

- Kingston

JORDAN

- Amman

INDIA

- Mumbai

- Pune

INDONESIA

- Jakarta

ITALY

- Bologna

- Milan

- Rome

IRELAND

- Dublin

KSA

- Riyadh-in partner with Bayan

MADAGASCAR

- Antananarivo

MALAYSIA

- Kuala Lumpur

MEXICO

- Mexico City

PHILIPPINES

- Manila

POLAND

- Krakow

REPUBLIC OF SINGAPORE

- Singapore

RUSSIA

- Moscow

SLOVAC REPUBLIC

- Bratislava

SLOVENIA

- Koper

SWITZERLAND

- Zurich

TAIWAN

- Taipei

TAJIKISTAN

- Dushanbe

TUNISIA

- Tunis

TURKEY

- Istanbul

UAE

- Dubai

UK

- London

USA

- Atlanta

- Denver

UZBEKISTAN

- Tashkent

VIETNAM

- Hanoi

- Ho Chi Minh City